MESA9 is as easy to use as any of the indicators built into NeuroShell Trader. As opposed to fixed rule indicators, all MESA indicators dynamically adjust to current market conditions.

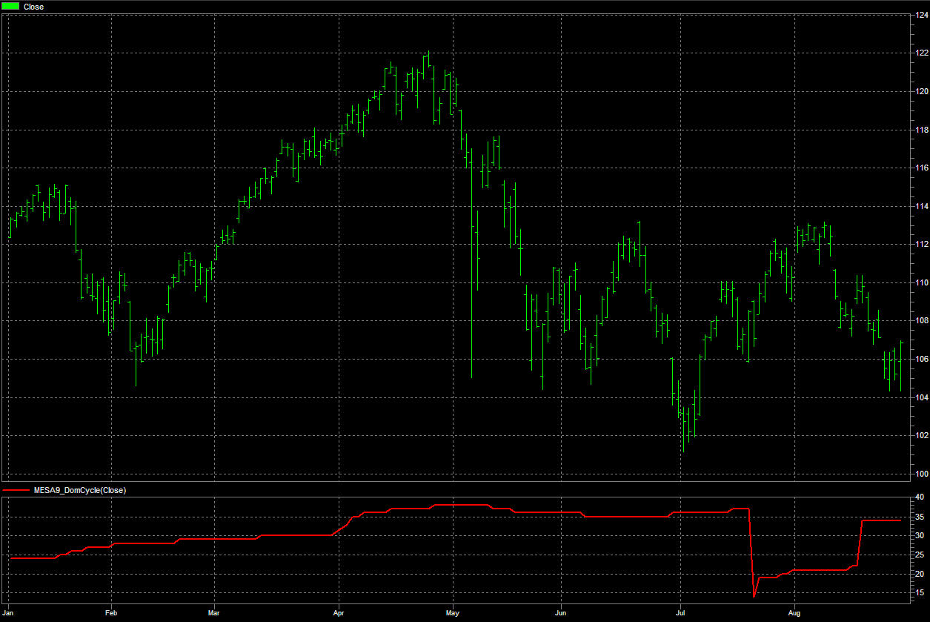

The premise of MESA is that market cycles are the one characteristic that can be scientifically measured. The MESA (Maximum Entropy Spectral Analysis) algorithm makes a high resolution estimate of the entire range of potential cycles. Experience has shown that there is typically only one tradeable cycle in the market at a time. This is the "dominant cycle" that is extracted from the spectral estimate by using a center of gravity approach so that the dominant cycle is the one containing the majority of the cyclic power. A real-world example of the spectrum as measured by MESA9 is shown in the following figure for SPY for the year 2010. The measured cycle period gradually increases from a 24 day period at the beginning of the year to a 38 day period in May. Then, the cycle period remains relatively stable until mid-July, where it drops to a near harmonic 20 day period. The near bimonthly cycle is then reestablished in mid August.

Figure 1. MESA9 Dominant Cycles for SPY in 2010